CNC machined parts are essential components in industries such as aerospace, automotive, medical devices, robotics, industrial automation, consumer electronics, and energy. When choosing where to source CNC parts, buyers typically compare China with other manufacturing regions including North America, Europe, and emerging Asian or Eastern European markets. This comparison must consider cost, quality, capability, lead time, communication, logistics, and risk management in a systematic way.

Overview of CNC Machined Parts Manufacturing

CNC (Computer Numerical Control) machining uses programmed toolpaths to remove material from a workpiece and produce precise components. The main industrial CNC processes include milling, turning, drilling, boring, tapping, and grinding, often combined in multi-axis machining centers.

Global CNC manufacturing capacity is distributed across a wide range of suppliers, from small job shops to large contract manufacturers. China hosts a particularly high density of CNC shops, integrated industrial clusters, and supporting material and surface-treatment providers, while other regions emphasize specialization, advanced quality assurance systems, or proximity to end markets.

Common CNC Processes Used Worldwide

- CNC milling: 3-axis, 4-axis, and 5-axis machining centers for complex geometries and prismatic parts.

- CNC turning: 2-axis and multi-axis lathes, often with live tooling for mill-turn operations.

- Grinding: surface, cylindrical, and centerless grinding for tight tolerance surfaces and fits.

- EDM (Electrical Discharge Machining): wire and sinker EDM for hard materials and sharp internal features.

Cost Structure: China vs Other Regions

Cost is a primary decision factor when evaluating CNC machining suppliers. Total cost comprises direct manufacturing cost, overhead, logistics, quality assurance, and indirect costs such as communication and engineering time.

| Cost Driver | China | North America / Western Europe | Other Asia / Eastern Europe |

|---|---|---|---|

| Labor cost | Generally lower hourly rates, variable by city and province | High hourly rates, strong labor regulations | Intermediate, often lower than Western countries |

| Machine amortization | Wide range of machines; high utilization in industrial clusters | High machine cost, often with advanced automation | Mixed; some regions invest in mid-range equipment |

| Tooling and fixtures | Competitive tooling costs; local toolmakers widely available | Higher tooling costs; emphasis on long life and precision | Moderate tooling costs; capabilities vary by country |

| Material sourcing | Extensive local supply of common metals and plastics | Strong traceability, higher base material prices | Local availability for common materials, some imports |

| Overhead and compliance | Variable overhead; regulatory requirements differ by region | Higher overhead from quality, environmental, and safety systems | Moderate overhead, depending on local regulations |

| Logistics to end market | International freight required for most export markets | Shorter transport for local customers; higher internal logistics cost | Regional proximity advantages for specific markets |

In many cases, China offers lower unit pricing for small to medium-sized CNC parts, especially when batch volumes justify setup and programming efforts. However, total landed cost must account for freight, customs duties, potential rework, and internal management overhead of an overseas supplier.

Equipment, Process Capability, and Part Complexity

The suitability of a region for CNC production depends on machine technology, automation level, process control, and experience with particular part types.

Machine Tool Types and Axes

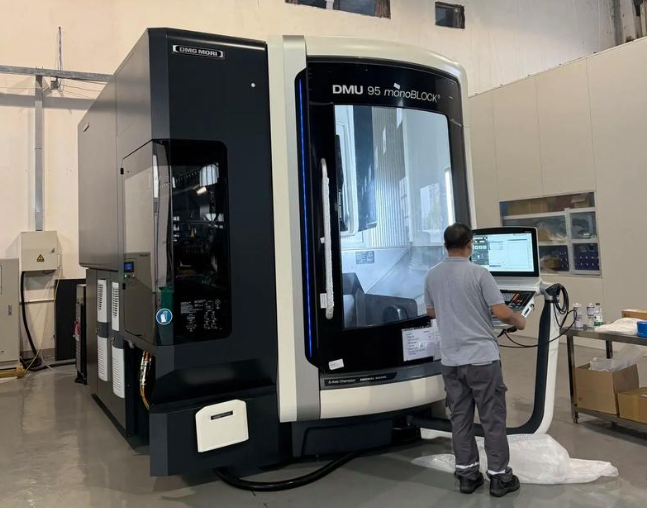

China hosts a mix of domestic and imported CNC machine tools. Many Chinese suppliers operate 3-axis vertical machining centers and 2–3 axis turning centers. Larger or more advanced facilities use 4-axis and 5-axis machining centers, horizontal machining centers, and multitasking mill-turn machines.

In North America and Western Europe, there is higher penetration of multi-axis machines and integrated cells designed for complex parts, high repeatability, and lights-out production. Other Asian and Eastern European suppliers vary; some focus on mid-range 3-axis equipment, while specialized shops invest in high-end multi-axis centers.

Dimensional Capability and Tolerances

Typical dimensional tolerances achievable with modern CNC machining are comparable across regions when using appropriate machines, tooling, and process controls. Many production shops worldwide can routinely achieve:

- Linear tolerances: ±0.01 mm (±0.0004") for standard precision work with suitable setups.

- Tight tolerance features: ±0.005 mm (±0.0002") or better on critical dimensions with controlled environments and measuring equipment.

- Geometric tolerances: position, concentricity, straightness, flatness, and roundness on the order of 0.01–0.02 mm, with tighter values on specialty parts.

The distinction is less about inherent regional capability and more about individual supplier investment in machine calibration, tool management, thermal control, and inspection equipment.

Material Availability and Specification Control

Material selection directly affects machinability, mechanical performance, and compliance with industry standards. Comparing China with other regions involves evaluating material sourcing channels, specification adherence, and traceability.

Metal Materials

Common metals used in CNC machining are widely available in China and globally:

Aluminum: Grades such as 6061, 6082, 5052, and 7075 are standard. China has substantial aluminum extrusion and plate capacity, with local and imported material. Many Western suppliers stock aerospace grades with detailed traceability and certification standards such as AMS or EN.

Steel and stainless steel: Carbon steels (e.g., 1018, 1045), alloy steels (e.g., 4140, 4340), and stainless steels (e.g., 303, 304, 316, 17-4PH) are common. Western suppliers typically provide extensive mill certificates and batch-level traceability. Chinese suppliers can also provide certified material; buyers often specify standards (ASTM, DIN, EN, GB) and require mill certificates and verification.

Copper alloys: Brass (e.g., C36000) and bronzes are commonly machined in all regions. Availability is not generally a constraint; the key is accurate grade matching and consistent mechanical and chemical properties.

Engineering Plastics

Materials such as POM (acetal), PA (nylon), PEEK, PTFE, PC, and ABS are machined in China and globally. For applications such as medical devices or food-contact components, sourcing with appropriate certifications (e.g., FDA compliance, specific ISO or EN standards) is more commonly emphasized by Western suppliers, but Chinese suppliers can also meet these requirements when specified.

Specification and Traceability Practices

In many Western facilities, material identification, lot tracking, and documentation are tightly integrated into ERP and quality systems. In China, traceability ranges from basic documentation for general industrial parts to full lot tracking and certificate management in more advanced or export-oriented shops. When sourcing in any region, buyers should specify required standards, certifications, and testing (e.g., chemical composition analysis, hardness, mechanical properties) in purchase documents.

Quality Management and Inspection Systems

Quality is determined by process discipline, inspection capabilities, and adherence to formal management systems rather than location alone. However, implementation levels and emphasis can differ regionally.

Quality Management Standards

Worldwide, many CNC suppliers implement ISO 9001 quality management systems. Medical, aerospace, and automotive applications might require specialized standards such as ISO 13485, AS9100, or IATF 16949, more frequently found in North America and Western Europe but increasingly present among Chinese export-oriented manufacturers as well.

In China, a broad range of suppliers exists: from basic shops with limited formal documentation to advanced facilities with comprehensive quality systems, process capability studies, and statistical process control (SPC). Buyers must carefully select suppliers whose level of quality management matches the application.

Inspection Equipment and Measurement Capability

Key inspection tools used globally include coordinate measuring machines (CMM), optical comparators, height gauges, surface roughness testers, hardness testers, and profile projectors. Advanced facilities in all regions may also deploy 3D scanning, vision measurement systems, and in-process probing.

Differences arise in the level of investment and routine use of these tools. Western suppliers serving regulated industries tend to document measurement procedures thoroughly and maintain calibration systems aligned with international metrology standards. In China, mid to high-tier CNC shops often possess similar equipment; the degree of structured measurement planning, calibration scheduling, and data recording varies by supplier.

Lead Time, Capacity, and Scalability

Lead time is influenced by queue times, process efficiency, internal capacity, and logistics. China and other major manufacturing regions each offer specific advantages depending on project requirements.

Prototype and Low-Volume Production

Many Chinese CNC shops specialize in rapid prototypes and small-batch runs. When communication and documentation are handled efficiently, machining and local finishing can be completed in a short time frame, with total lead time driven mainly by international shipping.

Local suppliers in North America or Europe can often deliver prototypes even faster from order to delivery, especially when buyers need frequent design changes, face-to-face review, or synchronized engineering collaboration. Freight times are shorter, and customs steps are simpler for domestic sourcing.

Medium to High-Volume Production

For repeat production with stable designs, Chinese suppliers frequently provide competitive cycle times and batch processing, leveraging industrial clusters for machining, heat treatment, and surface finishing. Large pools of subcontractors facilitate scaling to higher volumes without relocating production.

In Western regions, automated cells and high-end machinery support consistent high-volume production for local markets. The decision often balances lower labor-intensive costs in China against automation, proximity, and local logistics advantages elsewhere.

Communication, Documentation, and Engineering Support

Effective collaboration between buyers and CNC suppliers requires clear technical documentation, prompt communication, and aligned understanding of design intent.

Technical Communication Practices

In many Chinese shops, engineers and sales staff communicate in English at varying levels of fluency. Clear 2D drawings, 3D models, tolerance specifications, surface finish requirements, and material standards are essential to minimize ambiguity. Detailed documentation reduces risk of interpretation differences and rework.

Domestic suppliers in North America and Western Europe often share language, standards, and engineering conventions with local customers, which can reduce the time spent clarifying requirements and revising drawings. Engineering change management may be more integrated within shared digital tools and CAD/PDM systems.

Documentation Detail and Change Control

Globally, buyers benefit from specifying:

- Revision-controlled drawings and models.

- Dimensional tolerances, geometric dimensioning and tolerancing (GD&T), and surface finishes.

- Material standards and required certifications.

- Packaging, labeling, and identification requirements.

In China, documentation practices depend on supplier maturity and export experience. Some facilities maintain thorough document control systems; others rely more on informal tools. In Western regions, document control is often tightly integrated into quality systems and subject to periodic audits.

Surface Finishing, Heat Treatment, and Secondary Operations

Finished CNC machined parts frequently require additional processing. China and other regions differ in how these processes are integrated and coordinated.

Surface Finishing Options

Common finishing processes include anodizing (for aluminum), electroplating, powder coating, painting, bead blasting, polishing, and passivation. In Chinese industrial clusters, many of these services are available within short distances, allowing CNC shops to coordinate complete processing chains.

In North America and Western Europe, finishing suppliers are well established and regulated. Processes may have certification for sectors such as aerospace or medical devices, with detailed process control documentation. Lead times for finishing can add significantly to overall delivery time but provide documented consistency and traceability.

Heat Treatment and Hardening

Heat treatment operations such as quenching and tempering, case hardening, nitriding, and solution treatment are important for high-strength components. China has extensive heat treatment capacity for industrial applications, with specialized facilities for higher-spec parts. Western suppliers often work with certified heat treaters who provide detailed process records, hardness profiles, and test results.

Logistics, Shipping, and Packaging Considerations

Bringing CNC machined parts from the manufacturing site to the end user involves shipping modes, customs procedures, and packaging quality, all of which influence cost and risk.

| Aspect | China Exports | Domestic / Regional Supply (e.g., North America, Europe) |

|---|---|---|

| Transport modes | Primarily air freight for urgent and low-volume shipments; ocean freight for larger volumes | Truck, rail, or regional air; generally shorter distances |

| Transit time | Air: typically a few days plus customs; ocean: several weeks depending on route | Often 1–7 days within the same region |

| Customs and duties | Import duties and customs clearance required in destination country | Lower customs complexity within single customs area (e.g., EU) or domestic market |

| Freight cost sensitivity | Unit cost impact increases for low-volume, high-weight parts | Freight often a smaller portion of total cost for nearby customers |

| Packaging requirements | Need for robust export packaging, moisture protection, and labeling for long-distance shipment | Shorter transit can allow simpler packaging, depending on part sensitivity |

For precision parts, packaging must prevent corrosion, deformation, and surface damage. Both Chinese and non-Chinese suppliers can provide suitable packaging when specified, including VCI (volatile corrosion inhibitor) materials, desiccants, and custom foam inserts.

Intellectual Property and Confidentiality

Protecting intellectual property (IP) is a concern for many buyers when outsourcing CNC machining, especially for proprietary designs, unique geometries, and specialized fixtures.

IP Protection Measures

In any region, IP protection relies on contractual agreements, supplier selection, and internal control of sensitive information. Common measures include non-disclosure agreements (NDAs), restricted access to confidential models, and separation of design and manufacturing responsibilities where appropriate.

Some buyers choose to split production of critical assemblies among different suppliers or keep certain high-value features produced internally. These strategies can be applied regardless of whether the supplier is in China or another country.

Documentation and Data Handling

Careful control of CAD models, technical drawings, process documentation, and program files helps limit IP exposure. Data transmission should be handled through secure channels, and access rights at the supplier should be restricted to personnel directly involved in the project.

Industry and Application Alignment

Different regions have strengths in specific industries and applications, which affects their experience with relevant standards, tolerances, and surface requirements.

Industrial Focus Areas

In China, CNC machining widely supports consumer electronics, general industrial equipment, automotive components, and machinery parts. There is also significant activity in aerospace, telecommunications, and energy, especially among larger and more specialized manufacturers.

North America and Western Europe have strong presence in aerospace, medical devices, high-end automotive, and specialized industrial machinery, with extensive experience in regulatory compliance, documentation for audits, and long-term lifecycle support.

Other Asian and Eastern European regions often serve automotive, industrial equipment, and consumer product sectors, with competitive cost structures and growing technical capability.

Main Considerations When Choosing Between China and Other Regions

When selecting a manufacturing region for CNC machined parts, buyers must evaluate technical, commercial, and operational aspects in combination. The following considerations can guide decision-making:

1) Technical Requirements and Tolerance Demands

For parts with standard tolerances, moderate complexity, and common materials, qualified suppliers in China and other regions can meet requirements similarly. For parts with extremely tight tolerances, complex multi-axis geometries, or stringent regulatory documentation, some buyers prefer suppliers with specific industry experience and established compliance records, regardless of location.

2) Total Cost Calculation

Unit price differentials are only one component of total cost. Freight, customs duties, potential inspection and rework, engineering support, and internal management resources must all be included. For high-volume series, small differences in unit price may justify overseas sourcing. For low-volume, high-value prototypes, local suppliers can be cost-effective once overhead and time factors are considered.

3) Lead Time and Flexibility

Projects requiring frequent design iterations, rapid prototyping, or urgent replacement parts may benefit from geographically close suppliers with short logistics chains. For stable designs and recurring orders, longer supply chains from China may be acceptable, provided lead times are built into inventory and planning systems.

4) Quality Assurance and Documentation Needs

Buyers in regulated industries typically require extensive quality documentation: process validations, capability studies, material traceability, and inspection records. Such systems exist in China and elsewhere, but availability and maturity vary by supplier. For general industrial parts, simpler quality systems may be adequate, expanding the range of suitable suppliers.

5) Communication and Engineering Collaboration

Language, time zones, and cultural expectations influence the efficiency of engineering collaboration. Written, unambiguous specifications are essential when working across regions. For complex parts, simultaneous engineering, design reviews, and on-site visits may be simpler with nearby suppliers, while standardized parts with stable designs can be handled effectively across long distances.

Representative Parameter Ranges for CNC Machined Parts

Across China and other global regions, many CNC shops operate within similar general parameter ranges:

- Part size: from small components of a few millimeters to large parts exceeding 1 meter in length, depending on machine capacity.

- Tolerances: ±0.01 mm typical, tighter for critical features with appropriate process control.

- Surface roughness: Ra 0.8–3.2 μm for standard machining; finer finishes (e.g., Ra 0.2 μm or better) achieved with grinding, lapping, or polishing.

- Batch sizes: from single prototypes up to high-volume series with tens of thousands of units, contingent on supplier specialization.

These ranges apply globally; actual capabilities depend on individual supplier equipment, process control, and experience.

How to Evaluate and Compare CNC Suppliers

Whether sourcing in China or elsewhere, systematic evaluation of CNC suppliers is essential to ensure consistent quality, cost control, and reliable delivery.

Key Evaluation Criteria

Technical capability: Assess machine types, axis counts, maximum work envelope, supported materials, and example parts similar to your application.

Quality systems: Verify certifications, inspection equipment, calibration records, and sample quality documentation such as inspection reports and control plans.

Process transparency: Request process flow descriptions, sample control plans, and details on how nonconformities are handled and prevented.

Sample production: Use initial samples and pilot batches to evaluate dimensional accuracy, surface quality, packaging, and documentation completeness.

Communication: Review response times, clarity of technical discussions, and willingness to address detailed questions and potential design improvements.

FAQs: China vs Global CNC Machined Parts Sourcing

What are the main differences between China and global manufacturing of CNC machined parts?

China manufacturing typically offers cost advantages and scalability, while global manufacturing may focus more on regional compliance and shorter lead times.

Is China manufacturing more cost-effective for CNC machined parts?

In most cases, China manufacturing provides lower production costs due to labor efficiency, mature supply chains, and economies of scale.

When should companies choose global manufacturing over China for CNC machined parts?

Global manufacturing may be preferred for urgent delivery, small local batches, or projects requiring strict regional regulations.

What factors should be considered when choosing between China and global CNC machined parts suppliers?

Key factors include cost, quality standards, production volume, lead time, regulatory requirements, and long-term partnership potential.

Can China manufacturers handle high-precision CNC machined parts?

Yes, many China CNC machining factories specialize in high-precision parts with tight tolerances for aerospace, medical, and automotive industries.